The Real Cost of a Top-tier Liberal Arts Education

Tuition headlines miss the point. The real story is increasing levels of price dispersion and large subsidies, for everyone.

At one top-tier liberal arts college, the comprehensive fee covering tuition, housing, meals, and fees has risen by about 4% per year over the last decade, with the 2025–2026 bill clearing $90,000. Add books, travel, and incidentals and the total cost easily tops $100,000. Numbers like that tend to spark outrage, but they obscure the real story: increasing levels of price dispersion and subsidies, for everyone. Let’s dig into the numbers to see what is actually going on beyond the headlines.

What Families Actually Pay

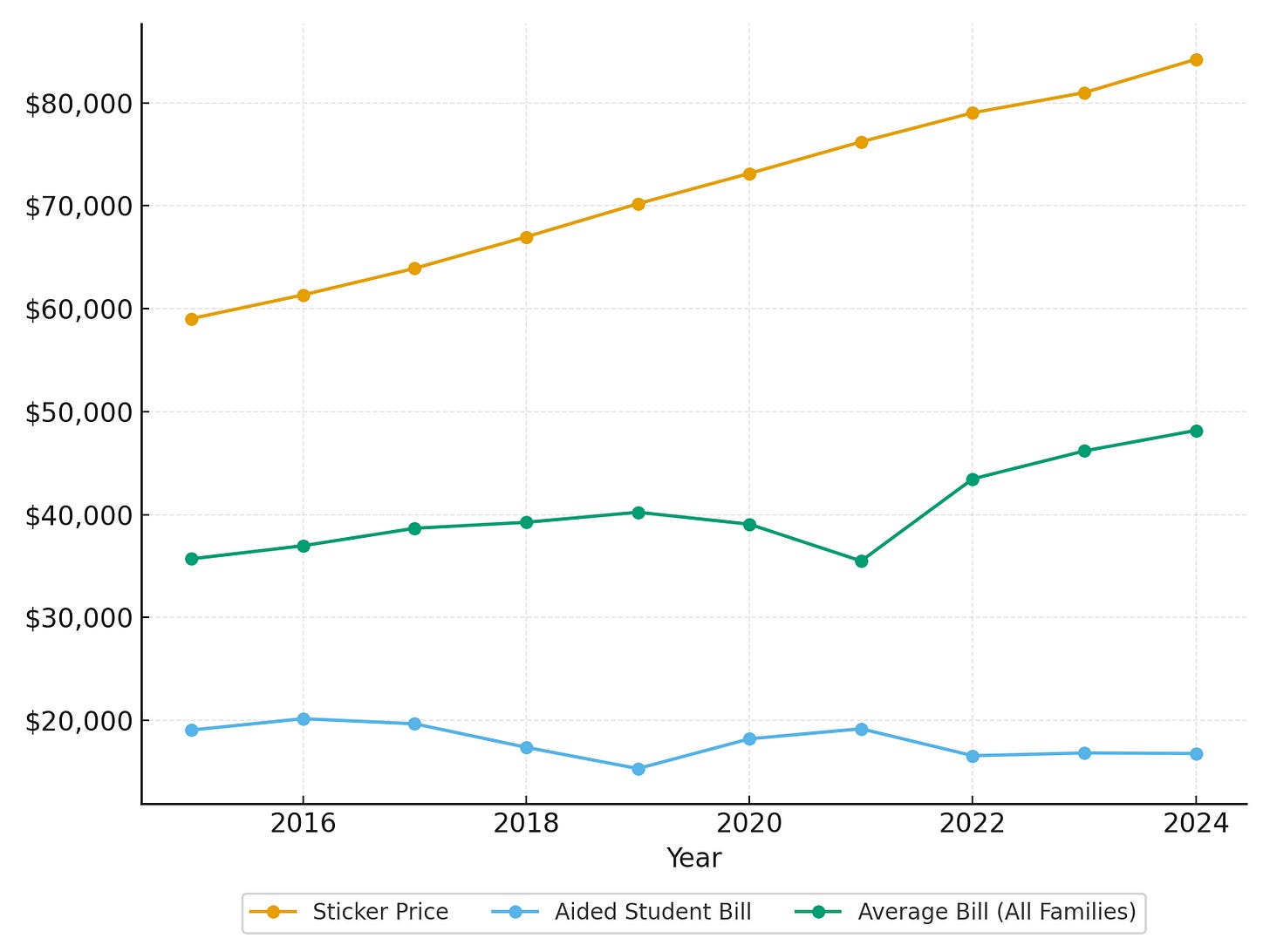

In 2024–2025, the sticker price at this institution was about $84,000. Yet the average family paid closer to $48,000, a 40% markdown.

Why? Roughly 55% of students received need‑based financial aid, and the average grant was about $67,000, leaving aided families with an average bill of just $17,000, an 80% discount off the sticker price.

The remaining 45% of families paid full price (~$84,000).

But not only do aided families pay significantly less than the sticker price, over the last decade they saw their average bill fall ~1.4% per year, even as the sticker price rose ~4% per year (Figure 1).

This trend runs counter to the popular narrative that higher education is becoming increasingly unaffordable. For low income families at this elite institution (and many of its peers), the cost of college has been falling, not rising.

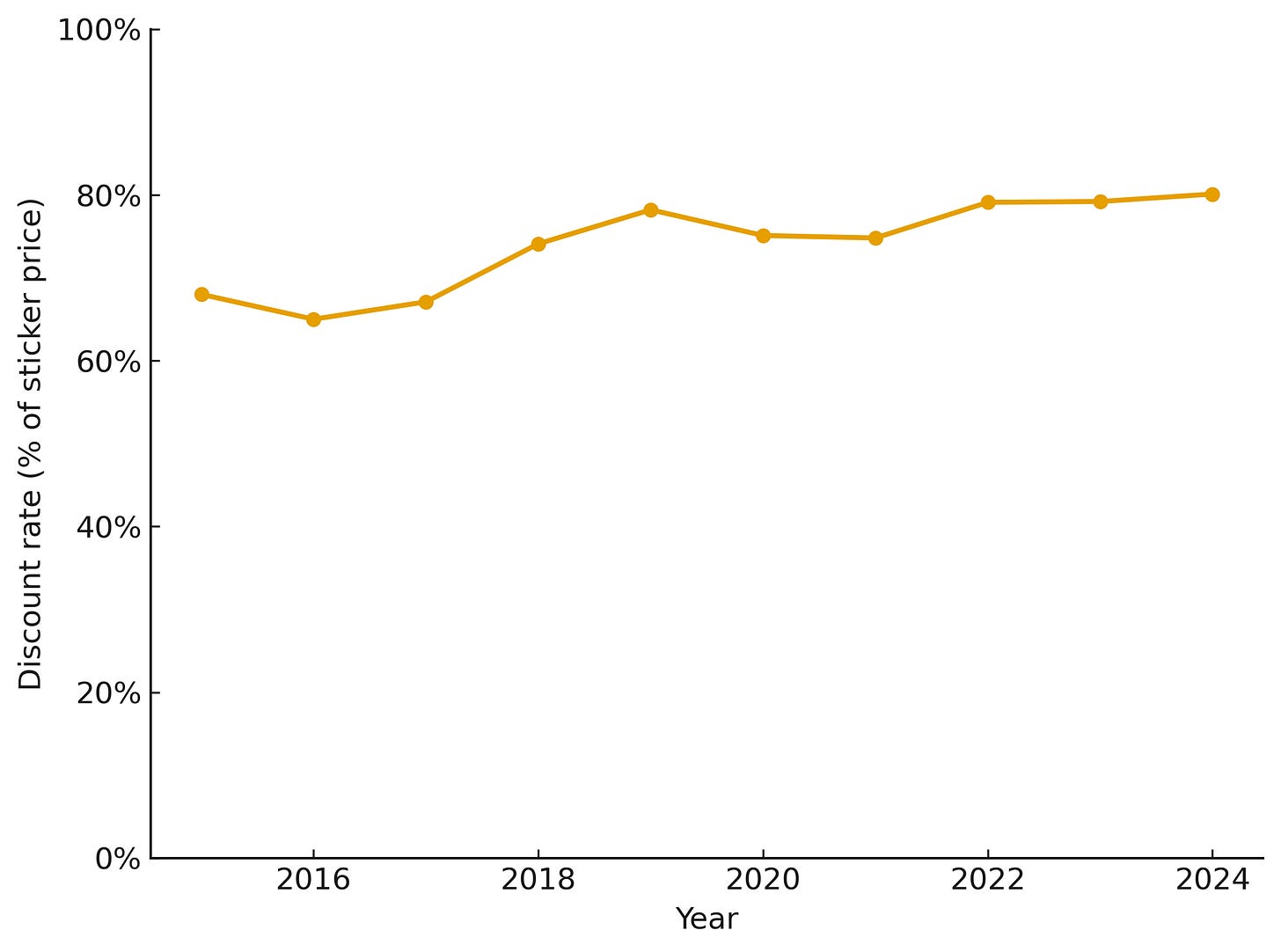

The average bill for aided families is being driven down by a secular increase in the average discount rate (% off the sticker price), which climbed from roughly 68% in 2015 to more than 80% by 2024 at this particular institution (Figure 2).

Why has the discount rate been rising? The publicly available data make it difficult to tell for sure. Most likely, though, it is due to a mix of (1) more generous financial aid packages and (2) shifts in ability to pay among aided families.

Regardless of the cause, the result is a widening gap between what families of students who qualify for financial aid and those who don’t are asked to pay. In 2015, aided families paid about $40,000 less than unaided families. By 2024, this gap was roughly $67,000, a 68% increase in only a decade. Like many of its peers, at this elite institution there is an increasing level of price dispersion between what aided and unaided families pay for their child’s college education.

Subsidies, for Everyone!

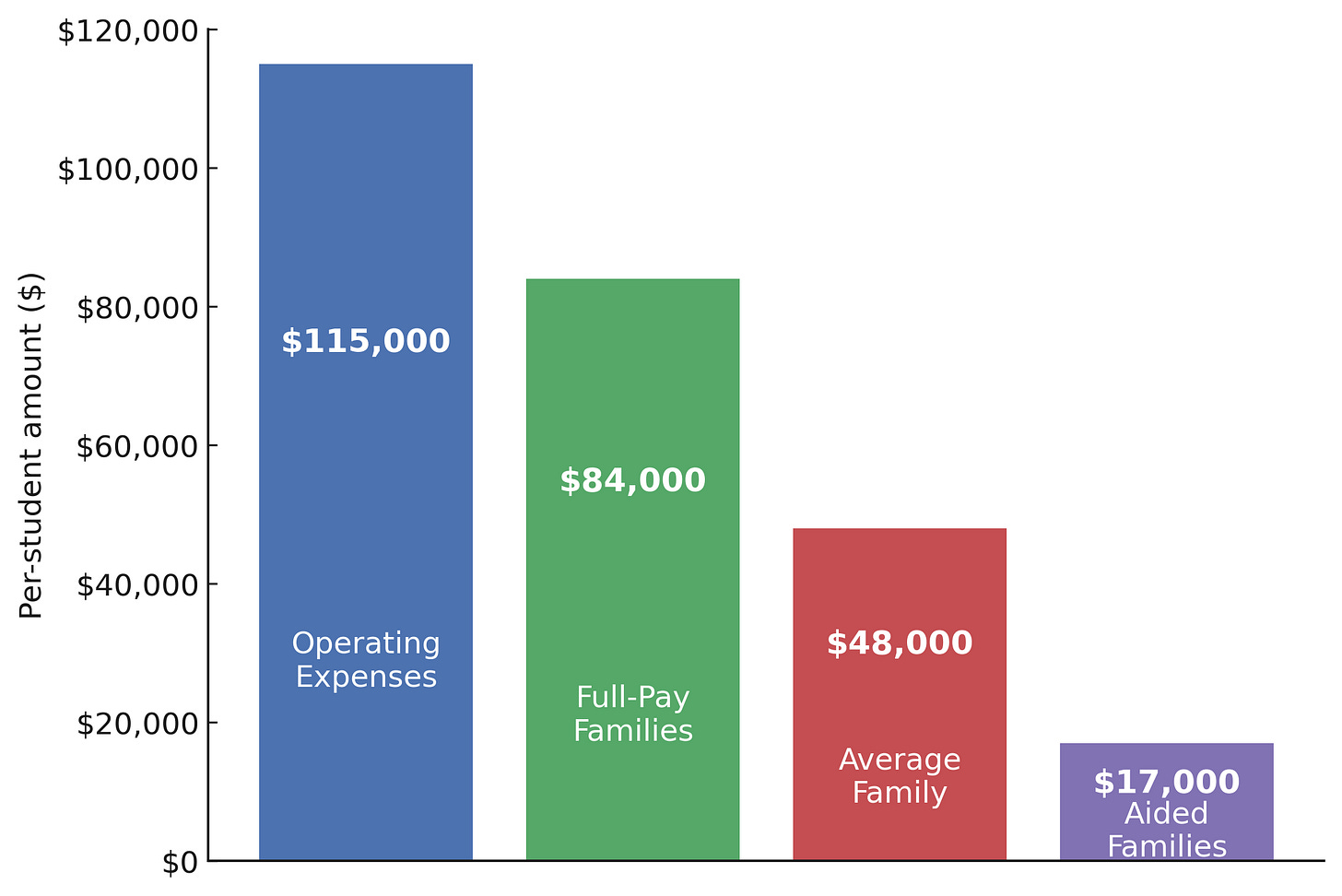

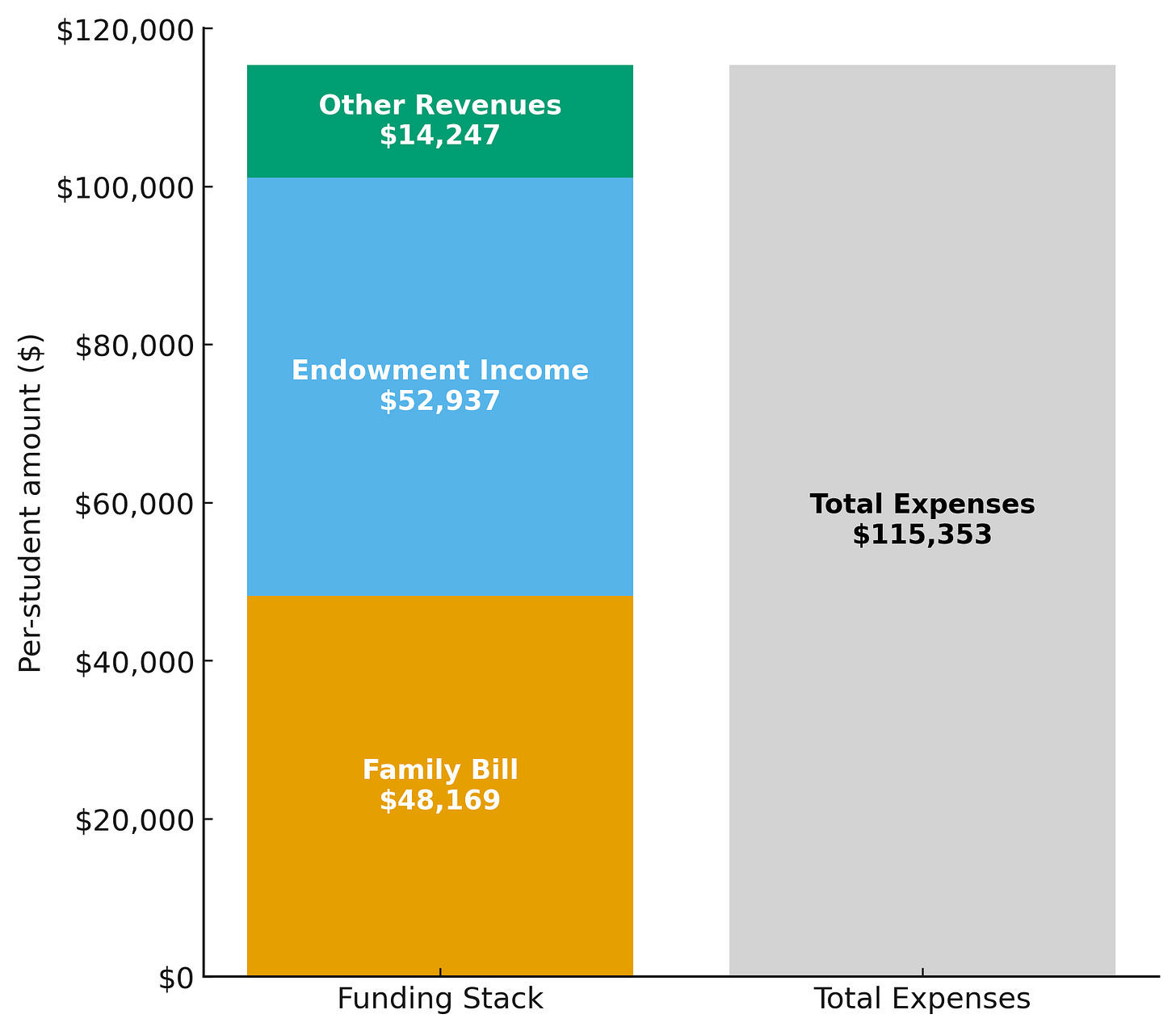

But that’s not the whole story. What is perhaps more surprising is that the sticker price, even at an eye-watering $84,000, is not even close to covering the full cost the college incurs to educate, house, and feed its students. Indeed, during the 2024–2025 academic year, per-student operating expenses topped $115,000. This means that even full-pay families received an implicit subsidy of ~27% off the true cost (Figure 3).

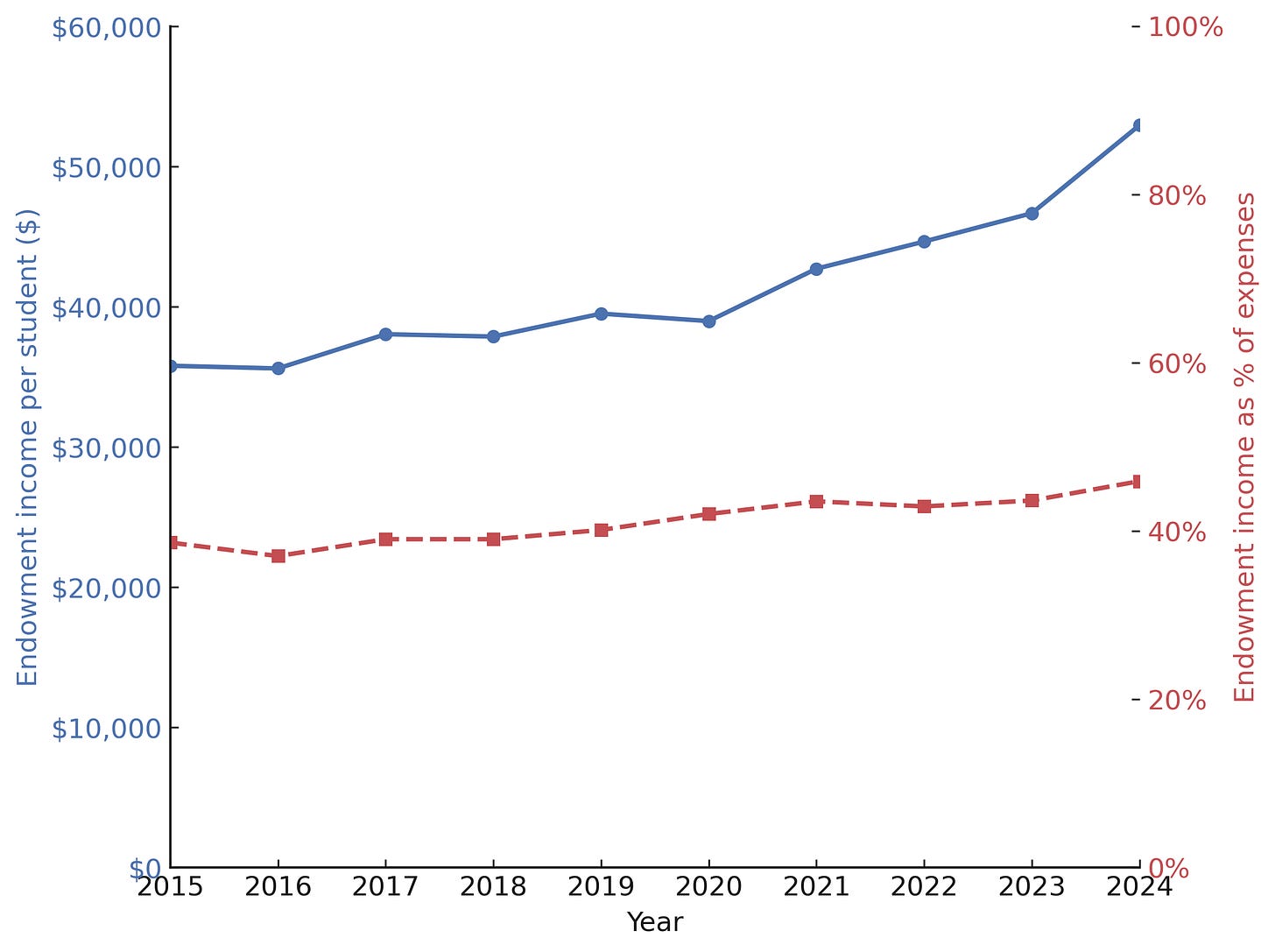

How can this institution afford to subsidize everyone? Revenue from the comprehensive fee covers about 42% of operating expenses. Income from the college’s multi-billion dollar endowment covers the vast majority of the remainder. By 2024, endowment income alone covered nearly half of per-student costs (Figure 4).

Gifts and other sources of revenue, while modest, are just enough to fill the rest of the gap not covered by endowment income and revenue from the comprehensive fee (“Family Bill” in Figure 5).

The funding gap between operating costs and what families, on average, actually pay is driven mainly by two factors: (1) the increasing discount rate (see Figure 2) and (2) competitive limits on sticker price increases.

Importantly, the funding gap is not the result of expenses spiraling out of control. At the institution in question, operating expenses have grown by about 2.5% per year over the last decade, slightly below economy‑wide inflation.

Key Takeaway

Two truths can coexist. For full-pay families, the price has risen steadily and is nearing six figures. For aided families, bills are much lower and have fallen over time, widening access to a top-tier liberal-arts education. Yet even full-pay families do not cover the true cost. The question is whether this model is sustainable as competition for college-bound students pushes discount rates higher and federal policy changes threaten endowment income and research funding.

Methods and Sources

All data reported in this post are based on publicly available information. Dollar amounts are nominal. Expense and revenue items are per-student unless noted. All inflation references refer to PCE. AI tools were leveraged by the author to construct some of the figures from raw data and to fine-tune the narrative.

If you enjoyed this mildly efficient and occasionally rational discussion of the real cost of a top-tier liberal arts college education, consider subscribing below. We’ll continue exploring markets and models, revealing mildly surprising truths. No hot takes; just thoughtful ones.

About the Author: Seth Neumuller is Associate Professor of Economics at Wellesley College where he teaches and conducts research in macroeconomics and finance. He holds a Ph.D. in economics from UCLA. His Substack is Mildly Efficient (and Occasionally Rational) where he explores topics in finance and macro from first principles, cutting through complexity with clear, grounded analysis.